Staying informed about raw material prices and trends is crucial for making informed decisions and maintaining a competitive edge. Raw material indexes serve as valuable tools that provide insights into price fluctuations, supply and demand dynamics, and market trends. In this blog post, we’ll explore some key raw material indexes that procurement professionals should follow to optimize their strategies and stay ahead of the curve.

Table of Contents

Key Raw Material Indexes.

US (examples)

CRU Commodity Price Indexes: CRU (formerly known as the Commodities Research Unit) provides a range of commodity price indexes covering various raw materials, such as metals, minerals, and fertilizers. These indexes offer comprehensive insights into market trends, allowing procurement professionals to monitor price movements and assess the impact on their sourcing strategies.

S&P Global Platts: S&P Global Platts is a leading provider of energy and commodities information, offering price assessments, analytics, and news for various raw materials, including oil, natural gas, coal, metals, and petrochemicals. By tracking Platts’ indexes, procurement professionals can gain valuable insights into energy and commodity markets to inform their decision-making process.

Fastmarkets MB: Fastmarkets MB (formerly Metal Bulletin) offers a wide range of price assessments, indexes, and market analysis for metals, including ferrous and non-ferrous materials such as steel, aluminum, copper, and nickel. Procurement professionals in the metals industry can benefit from tracking these indexes to stay informed about market trends and pricing dynamics.

CEPCI (Chemical Engineering Plant Cost Index): The CEPCI is an index published by Chemical Engineering magazine, providing a reliable method for tracking inflation trends in the process industries. Procurement professionals in the chemical and process industries can use this index to monitor cost trends and make informed decisions regarding their procurement strategies.

USDA Agricultural Commodity Price Indexes: The United States Department of Agriculture (USDA) provides agricultural commodity price indexes for various products, such as grains, oilseeds, fruits, vegetables, and livestock. Procurement professionals in the food and agriculture sectors can leverage these indexes to monitor price fluctuations and assess the potential impact on their sourcing strategies.

Europe (examples)

LME (London Metal Exchange): The LME is the world’s leading metal exchange, providing price discovery and hedging opportunities for metals such as aluminum, copper, zinc, nickel, lead, and tin. Procurement professionals can use LME prices as benchmarks for their metal purchases and to understand market trends in the European and global context.

EEX (European Energy Exchange): The EEX is a leading energy exchange in Europe, offering price assessments and trading opportunities for various energy commodities, including natural gas, electricity, coal, and emissions allowances. By tracking EEX indexes, procurement professionals can gain insights into European energy markets and make informed decisions about their energy procurement strategies.

PIE (Plastics Information Europe) PIE offers great advantages to executives who need to stay informed – a quick, yet in-depth look at plastics market developments – concise, competent and efficient. Standard/Engineering Thermoplastics, PU, Recyclate, Composites/GRP, Feedstocks – up-to-date prices for more than 100 plastic types.

Asia (examples)

SHFE (Shanghai Futures Exchange): The SHFE is one of the largest futures exchanges in Asia, providing price discovery and hedging opportunities for various commodities, including metals and energy products. Procurement professionals can use SHFE prices as benchmarks for their purchases and to understand market trends in the Asian context. (http://www.shfe.com.cn)

DCE (Dalian Commodity Exchange): The DCE is a leading commodity futures exchange in China, offering price assessments and trading opportunities for various agricultural and industrial commodities, such as soybeans, corn, palm oil, and plastics. Procurement professionals can monitor DCE indexes to track price trends and assess the potential impact on their sourcing strategies in the Asian market. (http://www.dce.com.cn)

How to Use Raw Material Indexes Effectively

- Benchmarking: Procurement professionals can use raw material indexes as benchmarks to compare their suppliers’ pricing against the market. This comparison helps ensure they are receiving competitive pricing and can identify potential cost-saving opportunities.

- Risk Management: Monitoring raw material indexes enables procurement professionals to identify market trends, anticipate price fluctuations, and implement risk management strategies, such as hedging or supplier diversification, to mitigate potential impacts on their supply chain.

- Contract Negotiation: By staying informed about raw material price trends, procurement professionals can negotiate contracts more effectively, leveraging market insights to secure favorable terms and conditions.

- Budgeting and Forecasting: Tracking raw material indexes can help procurement professionals develop more accurate budgets and forecasts, taking into account market trends and potential price fluctuations.

There is help – specialists in raw material markets (examples).

Here is a list of raw material market analytic firms based in the US, Europe, and Asia that can support procurement departments in their sourcing decisions:

United States

CRU Group: CRU is a leading provider of global commodity news, analysis, and consulting services, specializing in mining, metals, and fertilizers. CRU’s insights help procurement departments make informed decisions about sourcing and risk management.

S&P Global Platts: S&P Global Platts is a premier provider of energy and commodities information, offering price assessments, analytics, and news for various raw materials, including oil, natural gas, coal, metals, and petrochemicals. Platts’ expertise can guide procurement professionals in their sourcing decisions.

Europe

Argus Media: Argus Media is a UK-based independent media organization that provides market data, news, and analysis for energy and commodity markets, including oil, natural gas, coal, metals, and agricultural products. Their insights can support procurement departments in making strategic sourcing decisions.

ICIS (Independent Commodity Intelligence Services): ICIS is a leading market intelligence provider for the global energy, petrochemical, and fertilizer industries. With its extensive data, analysis, and consulting services, ICIS can help procurement professionals make informed decisions regarding their sourcing strategies.

Using Raw material indexes in purchasing contracts

As a buyer, understanding and utilizing price indexes in purchasing contracts is crucial for managing costs, predicting price trends, and ensuring fair pricing. Price indexes serve as tools to measure the average change over time in the prices paid by consumers for a market basket of goods and services. Here’s an informative text on the subject:

Understanding Price Indexes in Purchasing Contracts

Price Indexes: These are statistical measures that track changes in prices over time. They are vital in purchasing contracts as they help in adjusting prices based on market conditions, ensuring that neither the buyer nor the supplier is unfairly advantaged or disadvantaged by price fluctuations.

How to Calculate Price Development Using an Index

- Identify the Base Period: The base period is the time against which all other periods are compared. For instance, if the base period is set to the year 2020, all price changes will be compared to the prices in that year.

Determine the Current Period Index: Obtain the price index for the current period. This information is usually available from statistical agencies or industry reports.

Calculate the Price Change:

- Formula: Price Change (%)=(Current Period Index−Base Period IndexBase Period Index)×100

- Example: If the base period index is 100 and the current period index is 110, the price change is (110−100100)×100=10%.

Adjust Contract Prices: Apply the calculated percentage change to the contract prices. For example, if the price of a commodity in the contract was $1,000 and the price index increased by 10%, the new price would be $1,100.

Conclusion

Following key raw material indexes from North America, Europe, and Asia is an essential practice for procurement professionals seeking to optimize their strategies, manage risks, and make informed decisions. By staying up to date on market trends and price fluctuations across various regions, procurement teams can enhance their negotiation capabilities, improve budgeting and forecasting accuracy, and ultimately contribute to their organization’s overall success.

Market analytic firms provide valuable insights into raw material markets, trends, and price assessments, helping procurement departments make well-informed decisions regarding their sourcing strategies, risk management, and cost optimization. By leveraging the expertise of these firms, procurement professionals can stay ahead of market developments and ensure the success of their organizations.

Learn more about Indexes in the course Should Cost Analysis (free course). Should Cost analysis is a cost estimation technique used by procurement professionals to determine what a product should cost to manufacture and price development over time.

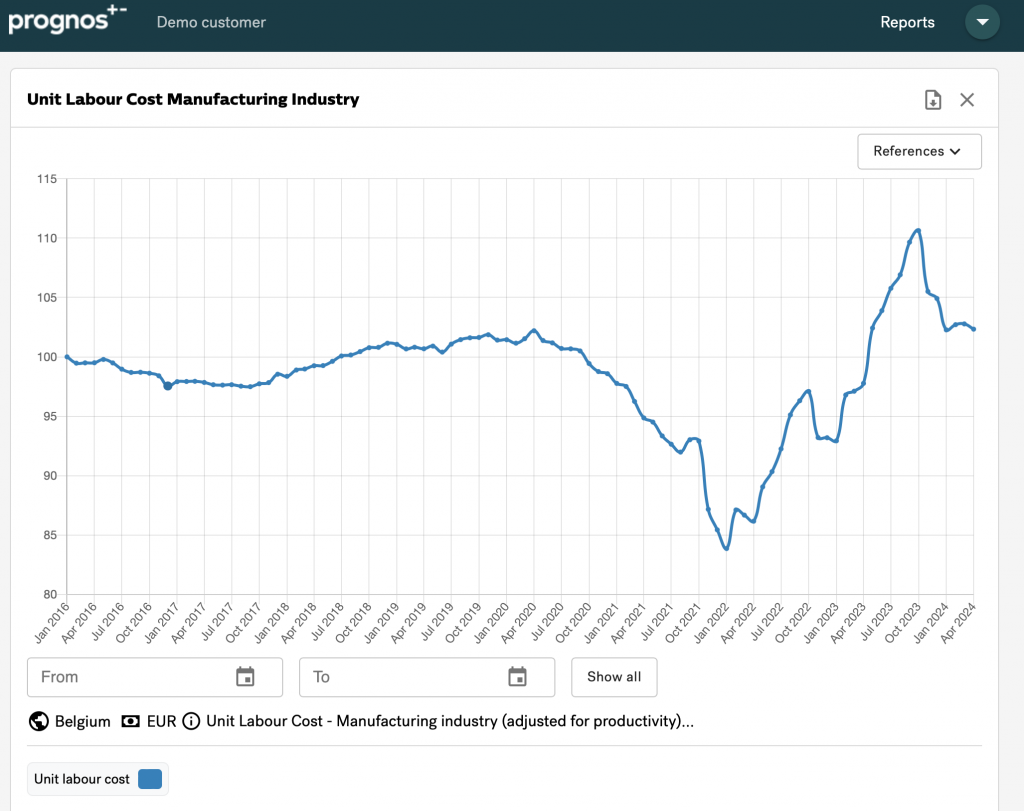

If you want an All in One Service from Prognos.

The company Prognos is a leading provider of cost analysis and procurement solutions, dedicated to supporting procurement organizations since 1983. The company offers a sophisticated digital platform that enables quick access to customized reports detailing cost changes for specific products. Their continuously updated data, managed by expert analysts, provides significant advantages in cost negotiations with suppliers. Prognos’s tools are designed to enhance fact-based decision-making and improve negotiation outcomes, making it an invaluable partner for procurement professionals seeking to optimize their strategies.

With Prognos Online you get access to over 8 000 indices on raw materials, components, wages and currencies in an interactive online tool capable of transforming the data to fit your needs. To Prognos.

Try the demo mode at Prognos (tailored).

Extra Reading: Types of Price Indexes a Buyer might need to know

Consumer Price Index (CPI): Measures changes in the price level of a market basket of consumer goods and services purchased by households.

Producer Price Index (PPI): Tracks changes in selling prices received by domestic producers for their output.

Commodity Price Index: Measures the price changes of a selected group of commodities such as food, metals, and energy.

Employment Cost Index (ECI): Tracks changes in the costs of labor for businesses in the U.S., including wages and benefits.

Import Price Index: Measures the change in the price of imported goods.

Export Price Index: Measures the change in the price of exported goods.

Gross Domestic Product (GDP) Deflator: Reflects the changes in prices for all goods and services produced in an economy.

Retail Price Index (RPI): Measures the change in the cost of a basket of retail goods and services.

Construction Cost Index: Tracks changes in the costs associated with construction projects, including materials and labor.

Raw Materials Price Index (RMPI): Measures price changes for raw materials purchased by manufacturers.

Agricultural Price Index: Reflects the changes in the prices received by farmers for their products.

Energy Price Index: Tracks changes in the prices of energy products like oil, gas, and electricity.

Metals Price Index: Measures price changes for various metals, including steel, copper, and aluminum.

Food Price Index: Monitors changes in the prices of food commodities.

Service Producer Price Index (SPPI): Tracks changes in the selling prices of services provided by businesses.

Wholesale Price Index (WPI): Measures the changes in the price of goods sold in bulk by wholesalers.

Manufacturing Unit Value Index (MUV): Reflects the changes in the prices received by manufacturers for their goods.

Chemical Price Index: Tracks changes in the prices of chemical products.

Freight Rate Index: Measures changes in the cost of shipping goods.

Housing Price Index: Reflects the changes in the prices of residential housing.

Understanding and effectively utilizing price indexes in purchasing contracts is essential for effective cost management and strategic procurement. By leveraging these indexes, buyers can ensure that their contracts reflect current market conditions, safeguarding their interests and promoting fair trade practices.

Note: Illustration to blogpost “Raw material indexes for Procurement” was created by Chat GPT on June 20, 2024.