In procurement, we often focus on securing the best price and favorable payment terms from suppliers. However, one factor that’s often overlooked is the supplier’s cost of financing. Suppliers face costs associated with how they finance their operations, whether through debt (borrowing money) or equity (raising money by selling shares). These costs, collectively referred to as Weighted Average Cost of Capital (WACC), play a crucial role in how a supplier builds its pricing structure and determines what payment terms they can offer.

Content…

In this blog post, we’ll explore how WACC influences supplier pricing, how it impacts their ability to offer extended payment terms, and why understanding your supplier’s WACC can be a valuable tool for negotiation. We’ll also include a case study where we calculate a supplier’s WACC and a comparison of two suppliers with different WACC rates, examining how these differences affect pricing and payment terms.

What is WACC?

WACC stands for Weighted Average Cost of Capital, which represents the average rate of return that a company must pay to finance its operations. In simple terms, it is the cost of obtaining capital through both debt and equity. Companies typically use both methods to raise funds, and WACC gives a combined rate that reflects their overall cost of borrowing and equity financing.

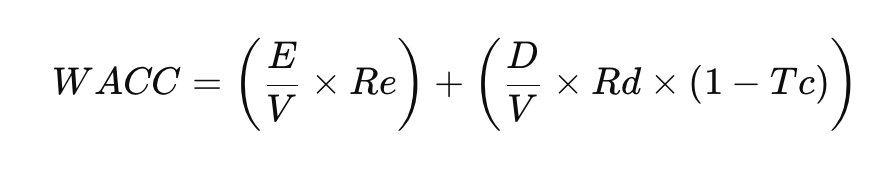

The formula for WACC is as follows:

Where:

- E = Market value of equity (shares)

- D = Market value of debt (loans)

- V = E + D (total capital)

- Re = Cost of equity (rate of return required by shareholders)

- Rd = Cost of debt (interest rate paid on borrowed funds)

- Tc = Corporate tax rate

Essentially, the WACC is the minimum return that a company must earn on its investments to satisfy both its shareholders (equity providers) and its lenders (debt providers).

Why WACC Matters for Suppliers

For suppliers, WACC represents the cost of maintaining their operations. If a supplier has a high WACC, it means they are paying more to secure financing. This higher cost is usually passed on to the buyer in the form of higher prices for goods and services. On the other hand, suppliers with a lower WACC have lower financing costs, which can lead to more competitive pricing and, potentially, more flexibility in offering favorable payment terms.

Additionally, WACC affects the supplier’s working capital. Suppliers with a low WACC have cheaper access to capital, which means they can afford to extend better payment terms to buyers, as their financing costs for carrying accounts receivable are lower. In contrast, suppliers with a high WACC may need to demand shorter payment terms or charge higher prices to cover their higher capital costs.

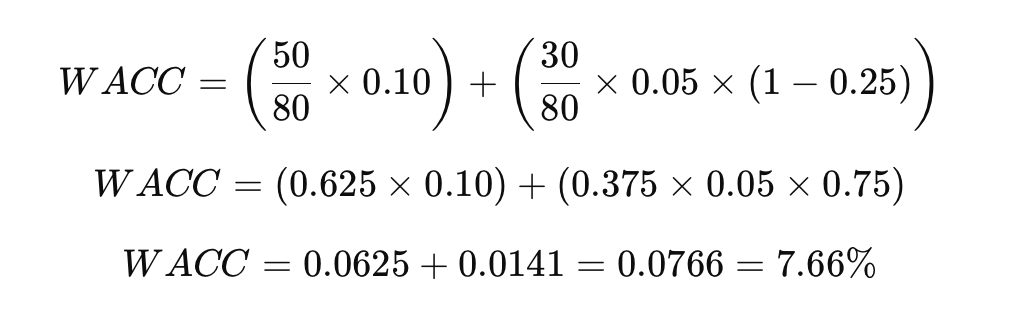

Case Study 1: Calculating Supplier WACC

Let’s consider a hypothetical supplier, Company A, which manufactures components for the automotive industry. We’ll calculate their WACC to understand how their financing costs influence pricing.

Company A’s Financial Data:

- Market value of equity (E): $50 million

- Market value of debt (D): $30 million

- Total capital (V = E + D): $80 million

- Cost of equity (Re): 10%

- Cost of debt (Rd): 5%

- Corporate tax rate (Tc): 25%

Using the WACC formula:

Company A’s WACC is 7.66%. This means that Company A needs to generate at least a 7.66% return on its capital to meet the expectations of both its shareholders and lenders.

Impact on Pricing:

With a WACC of 7.66%, Company A needs to incorporate these financing costs into its pricing structure. For example, if Company A’s operational costs are $1 million, it would need to earn an additional 7.66% ($76,600) to cover its capital costs, bringing the total cost to $1,076,600. This financing burden directly impacts the price offered to buyers.

Impact on Payment Terms:

Since Company A’s WACC is relatively low, they may be more willing to offer extended payment terms to their buyers. If their working capital needs are moderate, they could offer payment terms of 60 or even 90 days, as the cost of carrying the buyer’s debt (accounts receivable) would be manageable. A lower WACC means Company A can afford to finance the gap between delivery and payment without incurring significant costs.

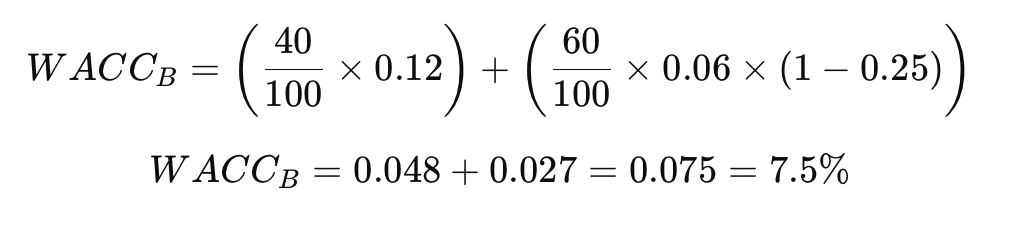

Case Study 2: Comparing Two Suppliers’ WACC

Let’s now compare two suppliers, Company B and Company C, to see how differences in WACC affect both pricing and payment terms.

Financial Data for Company B:

- Market value of equity (E): $40 million

- Market value of debt (D): $60 million

- Cost of equity (Re): 12%

- Cost of debt (Rd): 6%

- Corporate tax rate (Tc): 25%

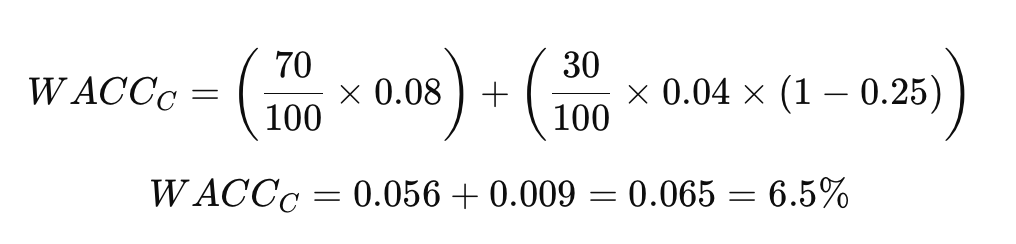

Financial Data for Company C:

- Market value of equity (E): $70 million

- Market value of debt (D): $30 million

- Cost of equity (Re): 8%

- Cost of debt (Rd): 4%

- Corporate tax rate (Tc): 25%

Company B’s WACC is 7.5%, while Company C’s WACC is 6.5%. While both companies have a relatively low WACC, Company C has a slight advantage in terms of lower financing costs.

Pricing Comparison:

Since Company C has a lower WACC, they can offer slightly more competitive prices compared to Company B. For instance, if both companies have operational costs of $500,000, Company B would need to add 7.5% ($37,500) for capital costs, while Company C only needs to add 6.5% ($32,500). As a result, Company C’s total cost would be $532,500, while Company B’s would be $537,500. This difference, although small, can make a significant impact in competitive industries where margins are tight.

Payment Terms Comparison:

Because Company C has a lower WACC, they are in a better position to offer extended payment terms. They may be willing to offer 90-day payment terms without incurring much additional cost. On the other hand, Company B, with its higher WACC, might prefer 30- or 60-day terms, as extending payment terms further would result in higher financing costs for them.

For the buyer, understanding this dynamic could be crucial. If the buyer needs longer payment terms, they might prefer working with Company C, as they can more easily absorb the cost of offering extended credit. Conversely, if short payment terms are acceptable, Company B might be equally competitive on pricing.

Connecting WACC with Supplier Product Cost Calculation

When we look at how suppliers calculate the cost of their products, understanding their Weighted Average Cost of Capital (WACC) can give us insights into how both financing costs and profit expectations are built into their pricing. In a product cost calculation, interest rate costs (related to debt financing) and the required return on equity (profit expectations) play a significant role. These factors determine not only the base price of the product but also the margin that suppliers need to meet their financing obligations and investor expectations.

Let’s break down how WACC influences supplier product cost calculation, and where interest rate cost and profit fit into this structure.

Supplier Product Cost Calculation Overview

Typically, a supplier’s product cost calculation consists of the following components:

- Direct Material Costs: The raw materials needed to manufacture the product.

- Direct Labor Costs: Wages paid to workers directly involved in production.

- Manufacturing Overheads: Indirect costs like electricity, machine maintenance, and factory operations.

- Interest Rate Costs (Debt Financing): The cost of borrowing money to finance production.

- Required Return on Equity (Profit Margin): The return that equity investors expect, often built into the price as a profit margin.

Each of these components contributes to the final price that a supplier charges. WACC is a key driver behind the interest rate costs and profit expectations. It helps the supplier determine how much return they need to generate to satisfy both debt holders and equity investors.

Where Interest Rate Costs Fit In

Interest rate costs are part of the supplier’s cost of debt. If a supplier uses loans or other forms of borrowing to finance production, they must pay interest on that debt. This interest becomes part of their overall cost structure and is reflected in the product’s price.

For example:

- Cost of Debt (Rd): If a supplier borrows money at a 5% interest rate, they need to ensure that the revenue generated from selling products is sufficient to cover not only the direct costs of production but also the interest on that borrowed money.

In the WACC formula, the cost of debt is factored in as a weighted component of the total cost of capital. The supplier’s overall financing strategy will determine how much of the product price needs to cover the interest payments.

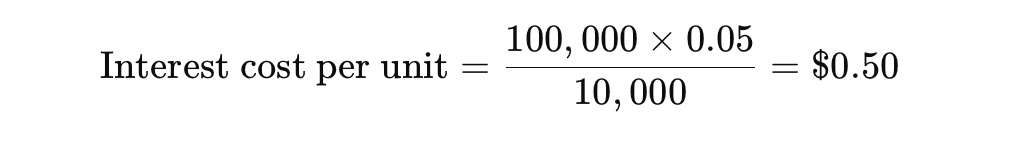

Example of Interest Rate Cost in Product Pricing:

If a supplier borrows $100,000 at 5% to finance production and expects to sell 10,000 units of the product, the interest cost per unit would be:

This means the supplier needs to add $0.50 per unit to the price to cover the interest expense.

It should be said this is an illustrative example and not always is financing cost allocated to a product in this way.

Where Profit (Return on Equity) Fits In

Profit expectations are directly linked to the supplier’s cost of equity—the return that shareholders or equity investors expect in exchange for providing capital. In the WACC formula, this is represented by the cost of equity (Re), which reflects the required return on investment for shareholders. Equity investors expect a certain rate of return, and this is built into the supplier’s pricing as profit margin.

Unlike interest payments on debt, which are fixed, the cost of equity is more variable and reflects the risk associated with the business. For example, if investors require a 10% return on their investment in the supplier, the supplier will incorporate that expectation into their pricing strategy to ensure they meet the return required by their shareholders.

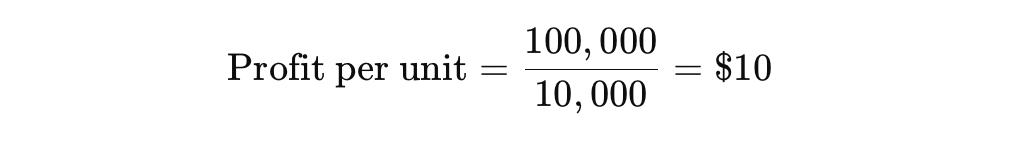

Example of Profit Expectation in Product Pricing:

If a supplier’s equity investors expect a 10% return, and the company has $1 million in equity financing, they need to generate $100,000 in profit to meet that expectation. If the supplier sells 10,000 units of a product, the required profit per unit would be:

Thus, $10 is added to the product price as the profit margin, ensuring the supplier meets their equity investors’ return expectations.

How WACC Influences Supplier Pricing

The WACC is the blended rate of both the cost of debt and cost of equity, and it reflects the overall cost of financing for the supplier. A lower WACC indicates cheaper financing, which means the supplier can afford to set lower prices or offer better terms without sacrificing profitability. A higher WACC, on the other hand, means the supplier has higher financing costs, which will likely result in higher product prices.

Case Example: Supplier A vs. Supplier B

Let’s compare two suppliers with different WACCs and see how this impacts their pricing:

- Supplier A has a WACC of 6% (lower cost of capital).

- Supplier B has a WACC of 10% (higher cost of capital).

Both suppliers have the same direct costs for producing a product—$50 per unit—but their WACC differs, which impacts how much they need to add to cover financing and profit.

Supplier A’s Cost Breakdown:

- Direct cost: $50

- Interest cost (cost of debt): $1

- Profit margin (cost of equity): $2

- Total cost: $50 + $1 + $2 = $53

Supplier B’s Cost Breakdown:

- Direct cost: $50

- Interest cost (cost of debt): $2.50

- Profit margin (cost of equity): $5

- Total cost: $50 + $2.50 + $5 = $57.50

Here, Supplier B has a higher WACC, which increases their total product cost by $4.50 per unit compared to Supplier A. This higher cost reflects both the higher interest payments on debt and the higher returns required by equity investors. Supplier B may need to charge a higher price to maintain profitability or offer shorter payment terms to reduce working capital needs.

In many procurement scenarios, especially when dealing with suppliers, WACC is used as a benchmark for determining the required profit margin for each product. This ensures that the supplier can cover both their cost of capital (debt and equity) and make a return that satisfies their investors or owners. Let’s break down how this works and why it’s important for both the supplier and the buyer.

Why WACC is Added as a Profit Requirement for Each Product

WACC represents the blended cost of capital for a company, combining both the cost of debt (interest payments on loans) and the cost of equity (returns expected by shareholders or investors). Since suppliers often need to finance their operations, WACC serves as a baseline for how much return they need to generate on their products to ensure they cover their financing costs and provide a return on investment.

By incorporating WACC into product pricing, suppliers can:

- Ensure Financial Sustainability: By factoring WACC into each product’s price, the supplier ensures that they are generating enough profit to cover their capital costs. This is crucial for maintaining financial stability and continuing operations in the long term.

- Maintain Investor Confidence: Investors (both debt holders and shareholders) expect a certain return on their capital. If a supplier consistently fails to meet their WACC, it could lead to investors pulling out or creditors increasing interest rates due to higher perceived risk. Including WACC in product pricing helps the supplier meet investor expectations and maintain access to capital at favorable rates.

- Set Competitive Yet Profitable Prices: By incorporating WACC into the profit margin, suppliers strike a balance between remaining competitive in the market while ensuring they generate a sufficient return. If they price too low without accounting for WACC, they may struggle to meet financial obligations. Conversely, pricing too high might reduce market competitiveness.

How WACC is Applied to Product Profit

When a supplier calculates the price of a product, they often break it down into different components:

- Direct Costs: This includes raw materials, labor, and overheads directly related to producing the product.

- Financing Costs: These are the costs associated with financing operations, including interest payments on loans (cost of debt) and the return expected by shareholders (cost of equity). The financing costs are directly influenced by the supplier’s WACC.

- Profit Margin: The profit margin ensures the company generates enough revenue above its costs. In many cases, the profit margin is linked to the WACC to ensure that the company meets its financing costs and makes a return that satisfies its investors.

For example, if a supplier has a WACC of 8%, they will aim to add at least 8% profit to each product’s price, ensuring they cover their cost of capital.

Example: How WACC is Integrated into Product Pricing

Let’s say a supplier manufactures a product with the following cost structure:

- Raw material cost: $100 per unit

- Labor cost: $50 per unit

- Overhead: $20 per unit

- Total direct cost: $170 per unit

Now, let’s assume the supplier has a WACC of 10%. This means that the company needs to ensure that each product generates at least a 10% return to cover the cost of both debt and equity.

The required profit per unit to cover WACC is calculated as:

Required profit=Total direct cost×WACC

Required profit=170×0.10=17

Thus, the supplier will need to add $17 per unit to the product’s price to cover their cost of capital. The final price charged to the buyer would be:

Final price=Total direct cost+Required profit=170+17=187

In this case, the supplier prices the product at $187 to ensure that they meet their WACC. This ensures that the supplier is not only covering all production costs but is also generating a return that meets the expectations of both debt and equity holders.

Conclusion

Understanding your supplier’s WACC can give you valuable insights into how they structure their pricing and how flexible they can be with payment terms. Suppliers with a lower WACC generally have more room to offer competitive pricing and extended payment terms, as their cost of capital is lower. Conversely, suppliers with a higher WACC may pass on higher financing costs through higher prices or may require shorter payment terms to manage their own working capital needs.

As a procurement professional, factoring WACC into your negotiations can help you not only secure better pricing but also tailor payment terms that work in your favor. By recognizing how financing costs influence your supplier’s bottom line, you can craft deals that benefit both parties and contribute to a more efficient and cost-effective supply chain.

Learn how WACC influence the supplier’s cost when changing payment terms in Learn How to Source’s course about Payment terms. The course present: Knowing the importance of payment terms (PT), the value that can be created and implications on the cash flow are important. Learn how to calculate the cost of capital, benefits that can be created and supplier cost for financing the PT. Competitive WACC means lower price and the possibility provide better payment terms at lower cost.

Note: Illustration to the blogpost was created by Chat GPT on September 20, 2024.