As a professional buyer, assessing financial health of a new supplier is crucial to ensure stable and reliable supply chains. This evaluation typically involves analyzing the Balance Sheet (B/S) and Profit and Loss (P/L) statements. Understanding these financial documents helps identify a supplier’s financial stability, profitability, and operational efficiency.

Content…

Key Indicators of Financial Health

- Liquidity Ratios: Indicate the ability of a company to meet short-term obligations. Key ratios include Current Ratio (Current Assets/Current Liabilities) and Quick Ratio (Quick Assets/Current Liabilities).

- Solvency Ratios: Reflect the company’s ability to meet long-term obligations. The Debt-to-Equity Ratio (Total Debt/Total Equity) is a critical solvency ratio.

- Profitability Ratios: Evaluate the company’s ability to generate profits. Important ratios are Gross Profit Margin (Gross Profit/Revenue) and Net Profit Margin (Net Income/Revenue).

- Efficiency Ratios: Assess how effectively a company utilizes its assets. Inventory Turnover (Cost of Goods Sold/Average Inventory) and Asset Turnover (Net Sales/Average Total Assets) are key efficiency metrics.

Financial Warning Signs

- Low Liquidity: Ratios significantly lower than industry averages can indicate a risk of default.

- High Debt Levels: Excessive leverage can signal financial instability.

- Declining Profit Margins: Consistent declines in profitability ratios may indicate operational troubles.

- Slow Inventory Turnover: Could signal ineffective inventory management or declining sales.

Recommended Questions to Suppliers

- “Can you provide your latest audited financial statements?”

- “How have your liquidity ratios trended over the last few years?”

- “What is your current debt-to-equity ratio compared to industry standards?”

- “Have there been significant changes in your profitability ratios recently? If so, what are the reasons?”

When assessing financial health of a new supplier – getting strong explanations to deviations is an absolute necessity, otherwise the supplier represent a supply chain risk.

Fictive Examples of Companies

Financially Healthy Company: StableTech Inc.

- Current Ratio: 2.5 (Industry Average: 1.5)

- Debt-to-Equity Ratio: 0.4 (Low compared to industry)

- Gross Profit Margin: 35% (Steadily increasing)

Efficient inventory turnover indicating good demand and inventory management.

Struggling Company: RiskyVentures Ltd.

- Current Ratio: 0.8 (Below industry average)

- High Debt-to-Equity Ratio: 2.0 (Indicating heavy reliance on debt financing)

- Declining Net Profit Margin: From 10% to 4% over three years

Slow inventory turnover suggesting overstocking or reduced demand.

Assessing financial health of a new supplier is a multi-faceted process that requires a careful analysis of various financial ratios and trends. By understanding these indicators, asking the right questions, and comparing financial data to industry benchmarks, procurement specialists can make informed decisions about partnering with new suppliers. This approach not only mitigates risks but also ensures a stable and efficient supply chain.

Case Discussion on Supplier Financial Health Analysis

Introduction to the Case:

Let’s consider a hypothetical case where our company, “ABC Procurement Inc.,” is assessing two potential suppliers: “StableTech Inc.” and “RiskyVentures Ltd.” Based on the provided financial information, students are encouraged to engage in a discussion to evaluate the financial health of these suppliers and decide which supplier would be a better choice for ABC Procurement Inc.

Fictive Financial Data:

StableTech Inc.:

- Current Ratio: 2.5

- Debt-to-Equity Ratio: 0.4

- Gross Profit Margin: 35%

- High inventory turnover

RiskyVentures Ltd.:

- Current Ratio: 0.8

- Debt-to-Equity Ratio: 2.0

- Net Profit Margin: Declined from 10% to 4% over three years

- Slow inventory turnover

Questions for Discussion:

Evaluating Liquidity:

- What do the current ratios of StableTech Inc. and RiskyVentures Ltd. suggest about their ability to meet short-term liabilities?

- How might the liquidity of these companies impact ABC Procurement Inc.’s decision?

Assessing Solvency:

- Discuss the implications of the debt-to-equity ratios for both companies. Is high leverage always a negative indicator?

Profitability Analysis:

- How do the profitability ratios of the two companies compare, and what does this indicate about their operational efficiency?

Inventory Management:

- What can be inferred from the inventory turnover rates of both companies? How does this reflect on their supply chain management?

Risk Management:

- Considering the financial health indicators, which supplier poses a higher risk to ABC Procurement Inc.? Discuss the potential risks of engaging with each supplier.

Final Decision:

Based on the financial analysis, which supplier should ABC Procurement Inc. choose? Are there scenarios where RiskyVentures Ltd. might be a preferable choice despite its financial indicators?

Assessing suppliers are part of following procurement processes

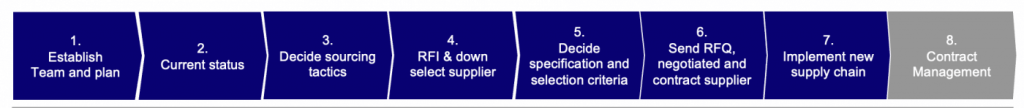

Assessing financial health of a new supplier part of the Sourcing process and keeping track of the current suppliers is the Know your supplier process.

Sourcing Process

Learn more about the sourcing process in the course Sourcing process 1. This course is designed to empower procurement professionals with the skills needed to effectively manage sourcing events. Sourcing execution is often considered the driving force behind a successful procurement department, and this course focuses on developing a thorough understanding of a modern sourcing process, including stakeholder management, which is crucial for any professional buyer. Step 4, when selecting suppliers for RFQ, is an example when assessing financial health of potential suppliers are recommended.

Know your supplier

In the Know your Supplier process, suppliers are continuously monitored in order to manage supply chain risk. In the course Know Your Suppliers you get an understanding that managing your supply base is more crucial than ever. The basic course is specifically designed to provide procurement professionals with a fundamental understanding of the process involved in collecting information about their supply base. This knowledge is key to identifying and mitigating the risks that can occur in supply chains.

Here’s a list of websites that provide financial information about companies in each European country:

Getting access to data, when assessing the financial health of a new supplier, can be supported by online services. Please note; only the sites where links are highlighted are validated:

- Austria: FirmenABC.at – Provides company information, financial data, and business news.

- Belgium: Graydon.be – Provides credit reports, risk management, and business data analysis.

- Bulgaria: BULGARIA-TRADE.COM – Provides a database of Bulgarian companies, financial data, and business news.

- Croatia: Fininfo.hr – Provides financial data, business news, and market analysis.

- Cyprus: Cyprusbusinessdirectory.com – Provides a database of Cypriot companies and business news.

- Czech Republic: Bisnode.cz – Provides credit reports, risk management, and business data analysis.

- Denmark: Proff.dk – Provides company information, financial data, and business news.

- Estonia: Bisnode.ee – Provides credit reports, risk management, and business data analysis.

- Finland: Asiakastieto.fi – Provides credit reports, risk management, and business data analysis.

- France: Infogreffe.fr – Provides company information, financial data, and business news.

- Germany: Unternehmensregister.de – Provides company information and financial data.

- Greece: Hellastat.com – Provides financial data, business news, and market analysis.

- Hungary: Ceginfo.hu – Provides company information, financial data, and business news.

- Iceland: Fyrirtaekjaskra.is – Provides company information and financial data.

- Ireland: CRO.ie – Provides company information and financial data.

- Italy: Infocamere.it – Provides company information and financial data.

- Latvia: Lursoft.lv – Provides credit reports, risk management, and business data analysis.

- Lithuania: Vrk.lt – Provides company information and financial data.

- Luxembourg: Registre-commerce.lu – Provides company information and financial data.

- Malta: Maltacompanies.com – Provides a database of Maltese companies and business news.

- Netherlands: KvK.nl – Provides company information and financial data.

- Norway: Proff.no – Provides company information, financial data, and business news.

- Poland: KRS-online.com.pl – Provides company information and financial data.

- Portugal: Iinforma.pt – Provides credit reports, risk management, and business data analysis.

- Romania: Monitorulfirme.ro – Provides company information and financial data.

- Slovakia: Firma.zoznam.sk – Provides company information and financial data.

- Slovenia: Ajpes.si – Provides company information and financial data.

- Spain: Axesor.es – Provides credit reports, risk management, and business data analysis.

- Sweden: Allabolag.se (in Swedish) – Provides company information, financial data, and business news.

- Switzerland: Moneyhouse.ch – Provides company information and financial data.

- United Kingdom: Companieshouse.gov.uk – Provides company information and financial data.

You are more than welcome to comment on list and suggest alterations. An example of a global source of data, when assessing financial health of a company, is Dun & Bradstreet.

Good luck assessing financial health of a new supplier and hinder new risk entering your supply chain.

About Learn How to Source

Learn How to Source (LHTS) is an online platform based in Sweden, offering a range of procurement courses accessible globally. It serves as a community where procurement experts share their knowledge through online courses, designed for various experience levels from introductory to expert. Courses are concise, about 30 minutes each, and cover different aspects of procurement, tailored for different buyer roles. The courses focus on practical knowledge, presented by seasoned professionals, and include quizzes and certificates. They can be accessed from any device, emphasizing microlearning for flexibility and efficiency.

Note: Illustration to the blogpost “Assessing financial health of a new supplier” was created with CHAT-GPT on January 21, 2024.